- Products & Solutions

- Environmental

- ETS

Compliance Carbon

An award-winning team of carbon market experts, ready to support your risk management strategy.

Your team of ETS compliance specialists

We specialise in supporting UK and EU Emissions Trading Scheme (ETS) operators across the industrial, aviation, and shipping sectors.

With CFP Energy, you can navigate complex regulations, manage allowance purchases and reduce exposure to market volatility through bespoke compliance strategies.

Tim Atkinson, Head of Carbon

"For companies covered by the EU Emissions Trading Scheme (ETS) and UK ETS, a paradigm shift is on the horizon. Both schemes are going through significant reform which will increase ambition and tighten the scheme targets to 2030 and beyond, as well as politicians exploring a possible link in the future.

Industrial and aviation operators will see a reduction in free allocations and shipping requirements increase to 100% by 2026. T his means every company will need to purchase more allowances at a time of forecast prices rises"

The ETS compliance challenge

Regulatory changes are forecast to increase future allowance prices and require new abatement technologies to achieve future emissions reduction targets. However, whilst decarbonisation plans remain on the drawing board, an effective allowance purchasing strategy is needed in the meantime.

Decarbonisation

You may be seeking carbon abatement opportunities to reduce ETS covered emissions, but do you have the technology and financing?

Budgeting

If technology and capital investment are not available, you will need to budget for higher compliance costs in the future, but can your business afford significant increases?

Carbon Risk Management

By working with CFP Energy, you can take advantage of favourable allowance prices and use carbon market solutions to proactively manage and reduce future ETS compliance costs.

Leading ETS strategy and support

Our award-winning team offers a full range of risk management solutions, including spot and forward allowance transactions, market orders to take advantage of sudden price movements and innovative products to manage future carbon price risk and reduce compliance costs.

The solution CFP Energy provides

Get concise updates on global and local policy as well as regular market insights to keep you up to date with carbon price movement, supporting your risk management strategy.

CFP Energy’s bespoke risk management solutions build on our experience of working with 1,000+ ETS operators over the past 15 years.

Reduce your compliance costs and develop a tailored strategy that takes into account procurement rules, budget requirements and your appetite for risk.

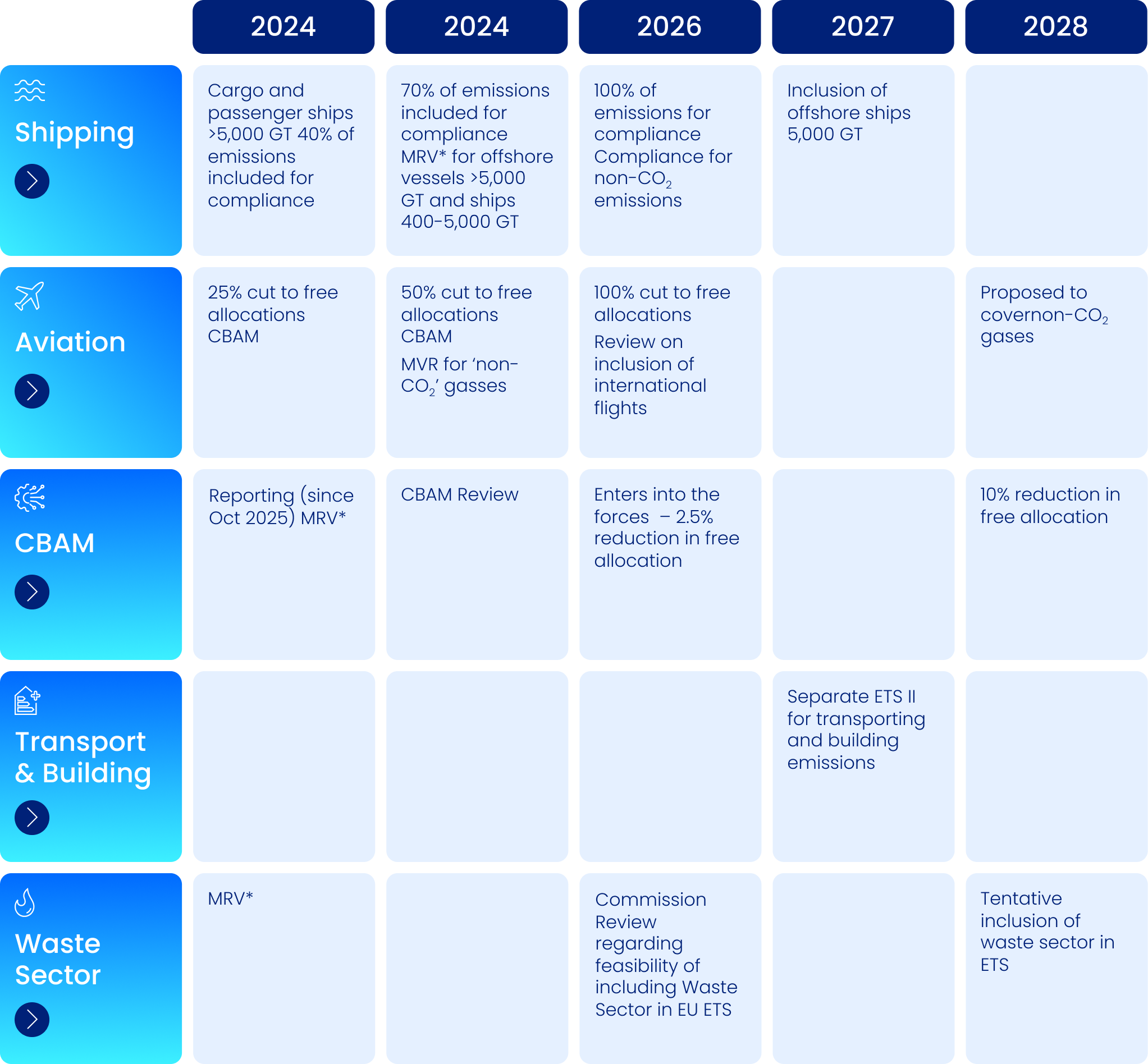

The ETS timeline...

Significant changes are on the horizon for a number of industries across the UK and Europe.

Decarbonising the Future: Navigating ETS Reforms & Net Zero Solutions

This report draws on data from a comprehensive survey conducted by CFP Energy across large-scale organisations in the UK, Germany, and France.

With insights from industries including aviation, data centres, shipping, construction, and manufacturing, the report highlights emerging strategies, investments, and the regulatory pressures driving the need for carbon reduction.

ETS FAQs

Tim Atkinson

Head of Carbon